According to publicly available information, the Langer Heinrich Mine is located in Namibia, 80 kilometers east of the major seaport of Walvis Bay and about 40 kilometers south-east of the large-scale, hard-rock Rössing uranium project operated by a subsidiary of Rio Tinto plc. The mine is a surficial calcrete type uranium deposit. The project is operated by Langer Heinrich Uranium (Pty) Ltd., a company that is 75% owned by Paladin Energy Ltd. ("Paladin") and 25% owned by CNNC Overseas Uranium Holding Limited, a wholly owned subsidiary of the China National Nuclear Corporation.

Construction of the Langer Heinrich Uranium Project commenced in 2005, and staged commissioning of the plant began in August 2006. The mine was officially opened in March 2007. On May 25, 2018, Paladin announced that the Langer Heinrich Mine was to be placed on care and maintenance and stopped presenting ore to the plant because of persistently low uranium prices.

In a news release dated April 2, 2024, Paladin announced restart of commercial production at the Langer Heinrich Mine, with the first production and drumming of uranium concentrates on March 30, 2024. Paladin indicated that their focus would now shift to ramp-up of production and building product inventory ahead of shipments to customers.

| Mineral Reserves – As of November 4, 2021 (100% Basis)(1) |

| Location |

Classification |

Tonnes (Mt) |

Grade (ppm U3O8) |

Content (Mlbs U3O8) |

| In situ – Open Pit |

Proved |

48.3 |

488 |

52.0 |

| In situ – Open Pit |

Probable |

10.0 |

464 |

10.2 |

| Stockpiles |

Proved |

26.5 |

369 |

21.6 |

| Total |

All |

84.8 |

448 |

83.8 |

| Mineral Resources – As of November 4, 2021 (100% Basis)(1) |

| Location |

Classification |

Tonnes (Mt) |

Grade (ppm U3O8) |

Content (Mlbs U3O8) |

| In situ – Open Pit |

Measured |

79.1 |

450 |

78.6 |

| In situ – Open Pit |

Indicated |

23.5 |

375 |

19.5 |

| In situ – Open Pit |

Inferred |

11.0 |

345 |

8.4 |

| Total In Situ |

All |

113.6 |

425 |

106.5 |

| Medium Grade stockpiles |

Measured |

6.3 |

510 |

7.1 |

| Low Grade stockpiles |

Measured |

20.2 |

325 |

14.5 |

| Total |

All |

140.1 |

415 |

128.1 |

(1) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, The JORC Code 2012 Edition, Effective 20 December 2012, mandatory from 1 December 2013. Prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia (JORC).

The Langer Heinrich Royalty was created pursuant to a letter agreement dated May 31, 2002, between Paladin Resources Ltd. (now Paladin Energy Ltd.), through its subsidiary, Paladin Energy Metals Ltd. (now Paladin Energy Minerals NL) and Aztec Resources Limited. Such royalty interest was subsequently acquired by Mega Redport Pty Ltd., a wholly owned subsidiary of Mega Uranium Ltd. The Langer Royalty is a PR royalty of A$0.12 per kilogram of U3O8 produced from the Langer Heinrich Mine and sold by Paladin and Paladin Energy Metals Ltd.

In a news release dated April 2, 2024, Paladin announced commercial production at the Langer Heinrich Mine, with the first production and drumming of uranium concentrates on March 30, 2024. Paladin indicated that their focus would now shift to ramp-up of production and building product inventory ahead of shipments to customers.

In an ASX release dated April 1, 2022 related to the successful completion of a A$200M placement, Paladin disclosed plans to begin the formal restart of the project in July 2022 and that Paladin was targeting commercial production from the Langer Heinrich mine to begin in CY2024.

In an announcement dated July 19, 2022, Paladin announced that its board of directors had made the decision to return the Langer Heinrich Mine to production, with first volumes targeted for the first quarter of calendar year 2024. Paladin further stated that total project capital expenditure had increased to US$118 million on a 100% project basis, (previous guidance of US$87 million), primarily driven by recent inflationary pressures across the project supply chain, brought forward power and water infrastructure works and increased owners team costs.

In a release dated November 4, 2021, Paladin Energy Ltd. ("Paladin") announced an update to the Langer Heinrich Restart Plan. Paladin also disclosed an updated mineral resource and ore reserve estimates for the Langer Heinrich mine. Paladin disclosed that the update confirms a 17-year mine life supported by ore reserves of 84.8 million tonnes with an average U3O8 grade of 448 ppm. The life of mine production target increased to 77.4 million pounds of U3O8 (previously 76.1 million pounds). The estimated life of mine C1 costs have been updated to US$27.40/lb (previously US$26.90/lb), primarily due to increased estimated contract mining rates. The restart plan update included a JORC(1) compliant mineral resource estimate for the Langer Heinrich Mine with measured resources of 78.6 million pounds of U3O8 (79.1 million tonnes at an average grade of 0.045% U3O8) and indicated resources of 19.5 million pounds of U3O8 (23.5 million tonnes at an average grade of 0.0375% U3O8). It further reports additional measured resources in medium-grade stockpiles totalling 7.1 million pounds of U3O8 (6.3 million tonnes at an average grade of 0.051% U3O8) and low-grade stockpiles totaling 14.5 million pounds of U3O8 (20.2 million tonnes at an average grade of 0.0325% U3O8). A 200ppm U3O8 cut-off was applied to in-situ mineral resources – 250ppm U3O8 cut-off was applied to stockpiles at the time of mining. Mineral resources are reported on a 100% ownership basis, of which Paladin has a 75% interest. The measured and indicated U3O8 mineral resources are inclusive of those mineral resources modified to produce the ore reserves (as reported below). Such resource estimate was reported on a depleted basis to June 30, 2018. The restart plan update also stated updated ore reserves, with proved reserves of 52.0 million pounds of U3O8 (48.3 million tonnes at an average grade of 0.0488% U3O8) and probable reserves of 10.2 million pounds of U3O8 (10.0 million tonnes at an average grade of 0.0464% U3O8). Paladin further reports additional proved reserves in stockpiles totalling 21.6 million pounds of U3O8 (26.5 million tonnes at an average grade of 0.0369% U3O8). Ore reserves are reported on a dry basis. Proved ore reserves are inclusive of ore stockpiles. 250ppm cut-off applied. The updated ore reserve is estimated using a metal price assumption of US$50/lb U3O8. Tonnage figures have been rounded and may not add up to the totals quoted. Ore reserves reported on a 100% ownership basis, of which Paladin has a 75% interest.

(1) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, The JORC Code 2012 Edition, Effective 20 December 2012, mandatory from 1 December 2013. Prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia .(JORC).

The information below regarding project milestones and recent developments for the Langer Heinrich Mine has been summarized from Paladin's public disclosure and from other publicly available materials.

The Langer Heinrich Mine deposit was discovered by General Mining Union Corporation Limited ("Gencor") in 1973. Between the late 1970s and 1980, Gencor completed substantial technical work, including a full project-evaluation study, metallurgical studies, multiple exploratory shafts and construction of a 300,000 tonne per year dry screen plant and pilot plant at the Langer Heinrich Mine. In 1998, the Langer Heinrich Mine was acquired by Acclaim Uranium, which completed additional drilling and a pre-feasibility study between 1999 and 2002. In August 2002, Paladin acquired Langer Heinrich Uranium (Pty) Ltd. from Aztec Resources Ltd (formerly Acclaim Uranium NL).

Paladin filed a resource estimation in April of 2005, and in July of 2005, announced that the Ministry of Mines and Energy in Namibia approved the grant of a mining licence covering the Langer Heinrich deposit for a 25-year term. Initial construction at the Langer Heinrich project started in September 2005, leading to the mine's official opening in March of 2007.

The Langer Heinrich Mine had its first full year of production in Paladin's fiscal year ended June 30, 2009. Since then, Paladin has completed two expansion projects, the first being the Stage 2 expansion in fiscal 2010 and the second being the Stage 3 expansion that took place in fiscal 2012.

In July of 2014, Paladin announced the completion of the sale of a 25% stake in the Langer Heinrich mining operations to CNNC Overseas Uranium Holding Limited. In May of 2018, Paladin announced that it has received the consent of relevant stakeholders to place the Langer Heinrich Mine on care and maintenance and that it had stopped presenting ore to the plant.

In its annual report for the year ended June 30, 2019, Paladin announced that in February 2019 it had completed a concept study that identified multiple options to reduce operating costs, improve process plant performance and potentially recover a saleable vanadium product. The annual report also disclosed that Paladin had commenced a two-stage pre-feasibility study respecting a potential re-start of mining operations at the Langer Heinrich Mine upon a sustained recovery in uranium prices.

On October 14, 2019, Paladin announced the completion of the first stage of its pre-feasibility study, which included a JORC(1) compliant mineral resource estimate for the Langer Heinrich Mine with measured resources of 71.87 Mlbs of U3O8 (66.2 million tonnes at an average grade of 0.049% U3O8) and indicated resources of 17.96 Mlbs of U3O8 (18.8 million tonnes at an average grade of 0.044% U3O8). Such resource estimate was reported on a depleted basis to June 30, 2018 and did not include stockpiles. Paladin's disclosure regarding the prefeasibility study included: (a) an estimate of US$80 million required for the rapid restart of the mine, including US$38 million for plant repair and improvement and US$42 million for working capital; (b) an initial production capacity of 5.2 Mlbs, while processing high and medium grade ores for approximately an 8-year period (after a 12-month ramp-up), followed by production capacity of 2.7 Mlbs while processing low grade ores for approximately 12 years; and (c) a resulting average life of mine all-in sustaining cost of approximately US$33 per pound, consisting of life-of-asset mining costs of US$8.40 per pound, processing costs of US$18.20 per pound, other operating costs of US$2.60 per pound and capital costs of US$3.80 per pound. Paladin further disclosed that it had identified opportunities, requiring estimated discretionary capital expenditures of US$30 million, to significantly debottleneck existing mining and mineral processing operations to 6.5 Mlbs per year and reduce all-in sustaining costs by approximately US$4.50 per pound.

On June 30, 2020 Paladin announced the result of the Langer Heinrich Restart Plan, which refined the results of the previous Prefeasibility Report. The Restart Plan was based on a re-sequencing of mining and processing activities outlined in the 2019 PFS and takes elements from both the PFS 5.2Mlb Option and the PFS 6.5Mlb Option. The release also stated a C1 Cost of Production of US$27/lb and a 17-year mine life with peak production of 5.9 Mlbs of U3O8 for seven years. The Life of Mine Plan outlines three distinct operational phases; Ramp-Up (Year 1), Mining (Years 2 – 8) and Stockpile (Years 9 – 17).

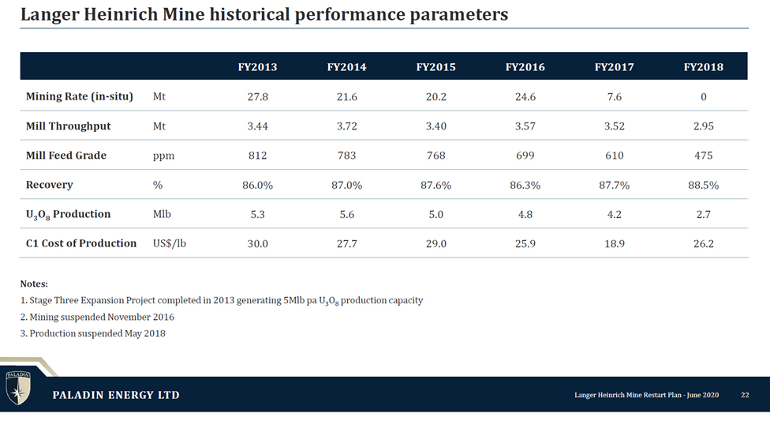

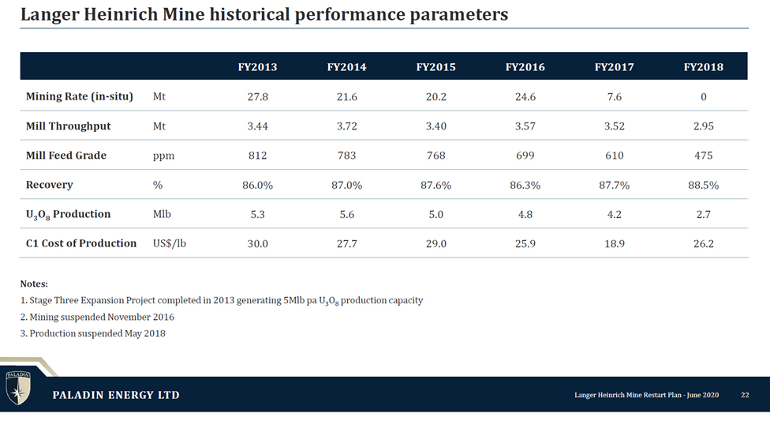

The table below sets forth historic performance parameters for the Langer Heinrich Mine between 2013 and 2018, as reported by Paladin in its Langer Heinrich Mine Restart Plan Presentation released on June 30, 2020.

Back to Portfolio

Back to Portfolio